BIJOU

Automated transaction classifier and client event detection for retail banks.

Bijou is an analytical platform that in real-time categorizes client transactions and generates client events. The platform processes millions of transactions per minute, and distributes them to multiple internal clients, such as risk management and campaign management. Bijou can also feed client-facing applications, such as Spending report of Automated Financial Advisory.

90+% transactions classified

95+% classification accuracy

100+ client events and characteristics

Real-time capability

Deep AI-driven localization

Visualization options

BIJOU USE CASES

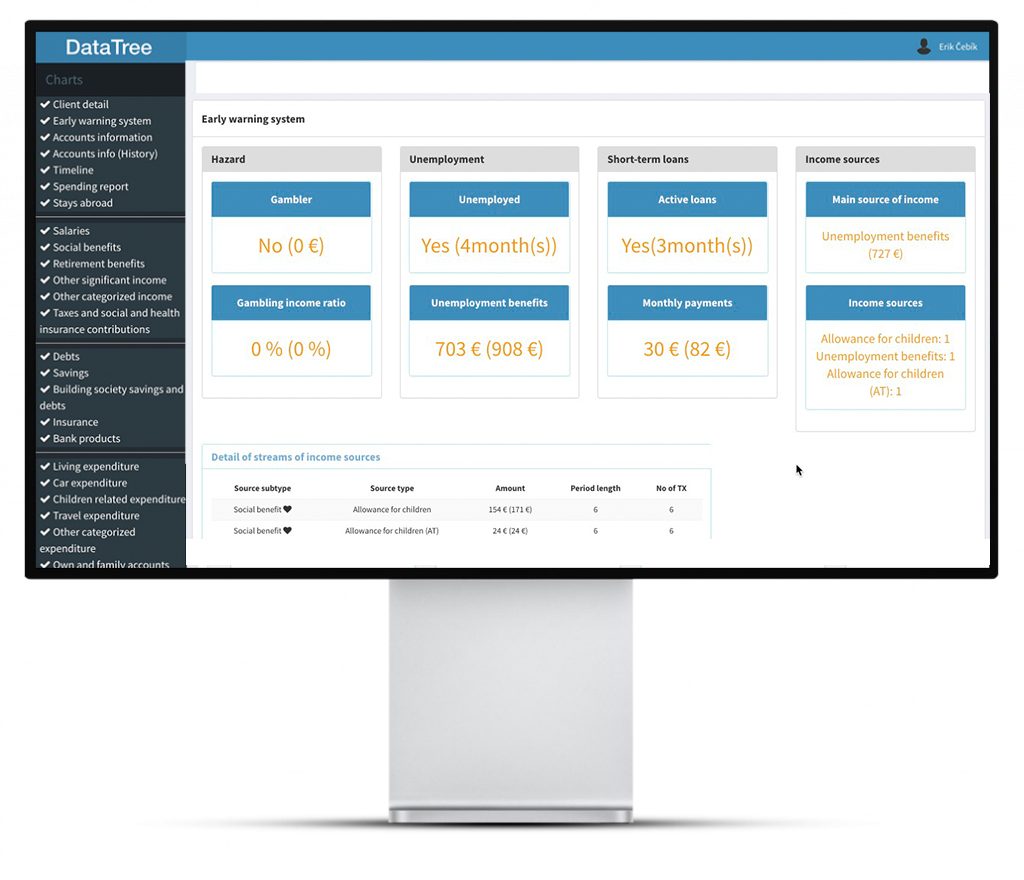

ENHANCED RISK MANAGEMENT

Detailed understanding of clients’ income sources and detection of early signs of financial distress

- High accuracy income classification to support risk modeling and automated loan pre-approval

- Portfolio of events to identify early signs of financial distress

- Identification of behavior patterns leading to risky behavior and diminished repayment capability

SALES EFFECTIVENESS

Targeted digital and offline sales through automated

deployment of actionable client events and characteristics

- Extensive portfolio of client events to drive digital and offline sales of financial products and services

- A long list of client characteristics to support granular client segmentation for targeted campaigns

- Advanced propensity-to-buy modeling based on enriched transactions and client events/characteristics to complement final client filtering

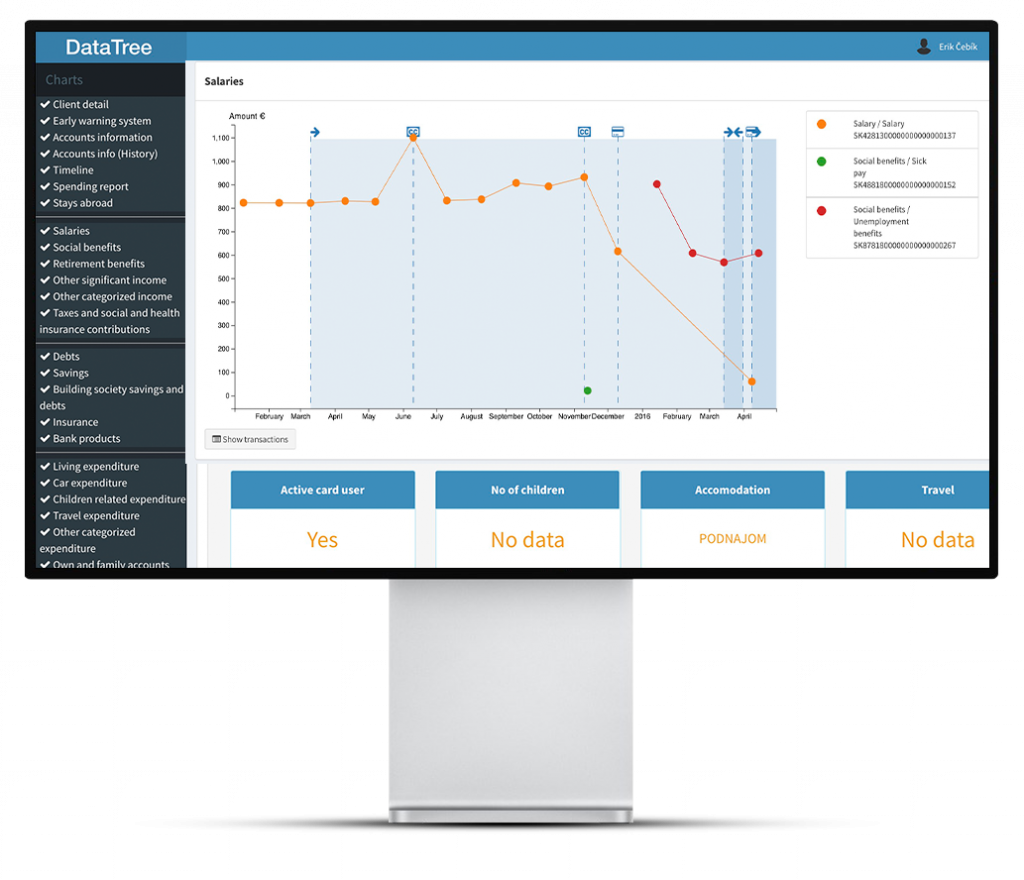

SPENDING REPORT

State-of-the-art transaction categorization to support client facing spending reports and PFM use

- Advanced machine learning pipeline to comprehensively pre-classify 95+% of all client transactions with special focus on bank transfers

- High performance processing allowing for real-time classification – clients see their new transactions classified instantly

- Ability to instantly classify transactions imported from other banks

- Multiple PFM use-cases such Free-to-spend or Room-to-save available on top of advanced transaction classification

ERNEST

White-label automated financial advisor

Ernest is a unique blend of advanced transaction analytics, behavioral sciences and powerful omnichannel delivery via a two-way messaging capability.

Through powerful transaction analytics, Ernest helps clients understand their overall household, car or entertainment related expenses, helps them improve their monthly salary-to-salary cash flow or looks for saving potential in clients’ discretionary and regular spending.

Ernest beats the traditional PFMs by being accurate, insightful and proactive. It‘s, in essence, a platform for behavioral change – a set of programs helping clients move from point A (e.g. no financial reserve) to point B (e.g. financial reserve for 3-6 month of household expenses).