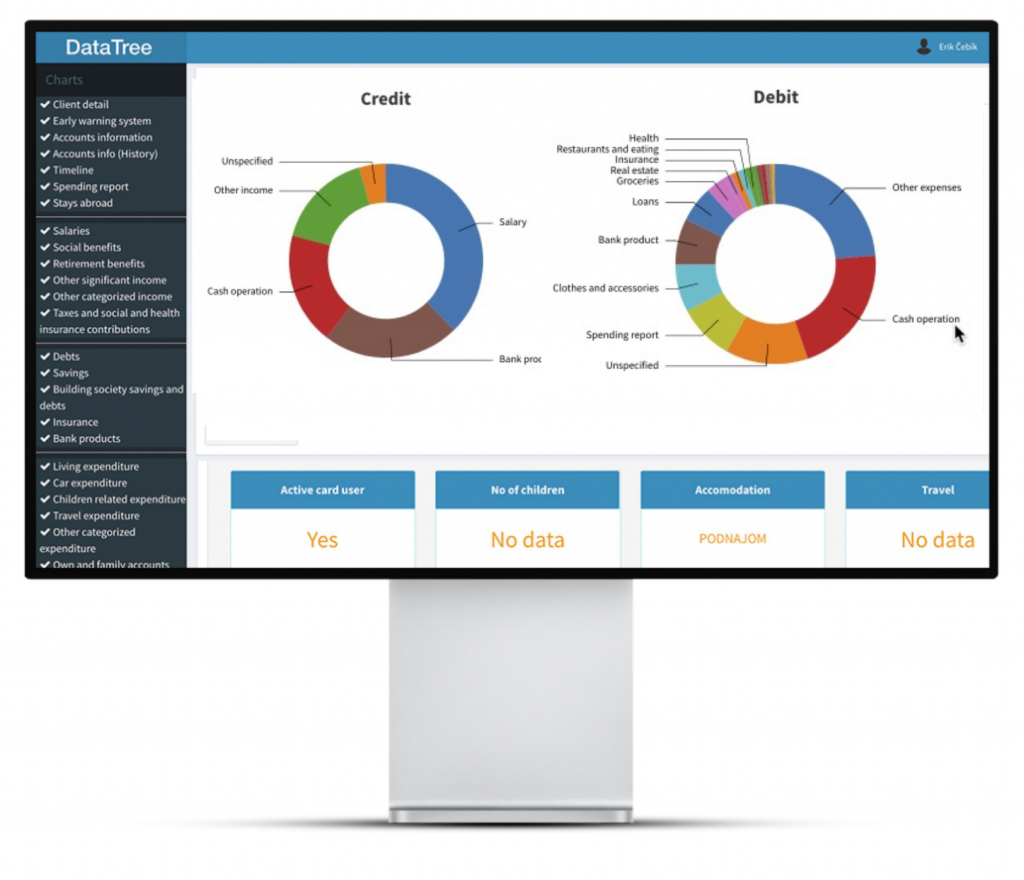

Automated transaction enrichment

Helping all internal clients of a retail bank benefit from accurate and comprehensive transaction enrichment.

- State of the art machine learning pipeline to classify bank transfers with recall over 90%+ including detection of own accounts at different banks

- Performance optimized rule-based TX classifier using machine learning to inform parameter values

- Classification logic addresses information stored in account-to-account streams as well individual transactions within streams

- Automated monitoring module

Sales effectiveness

Driving digital and offline sales through automated deployment of actionable client events and characteristics.

- Portfolio of more than 100 client events to drive digital and offline sales of financial products

- A long list of client characteristics to support granular client segmentation for targeted campaigns

- Advanced propensity-to-buy modeling based on enriched transactions and client events/characteristics to complement final client filtering

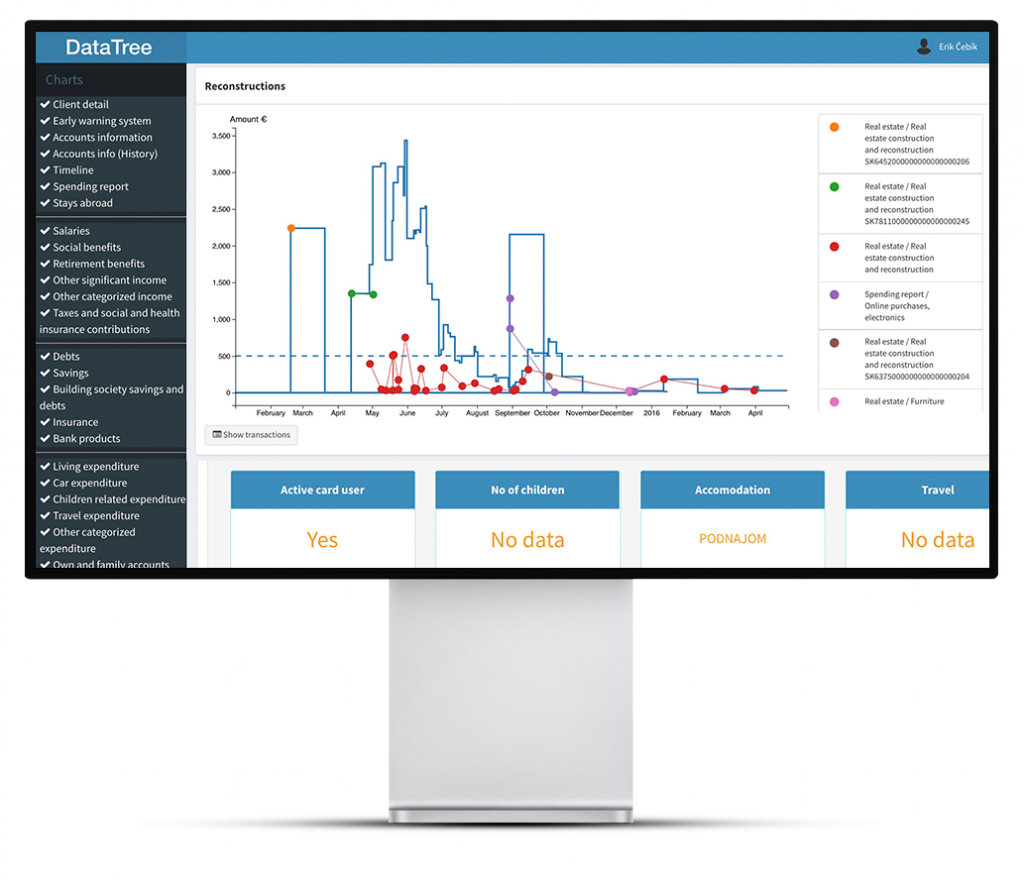

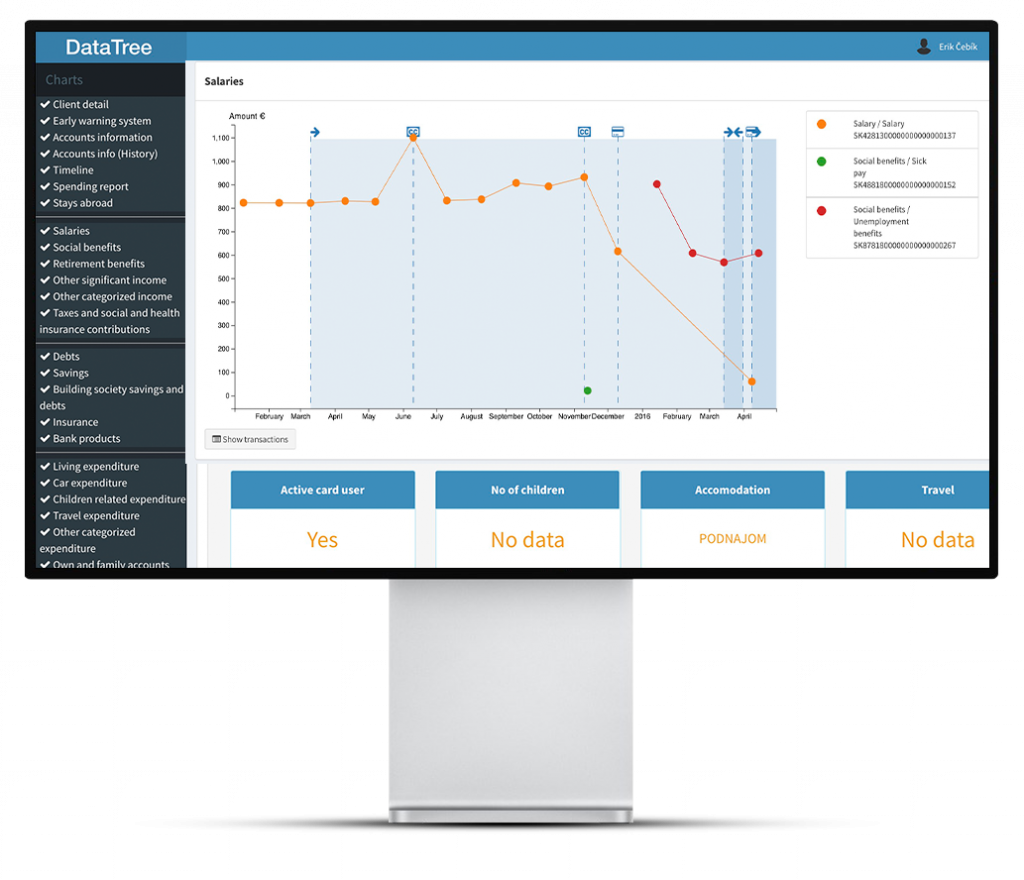

Enhanced risk management

Understanding clients’ income profiles and detecting early distress signals

- High accuracy classification of income streams to support risk modelling

- Detection of income related client events e.g. start of entrepreneurship or loss of employment

- Portfolio of more than 50 events to identify early signs of financial distress

- Identification of behavior patterns leading to diminished repayment capacity

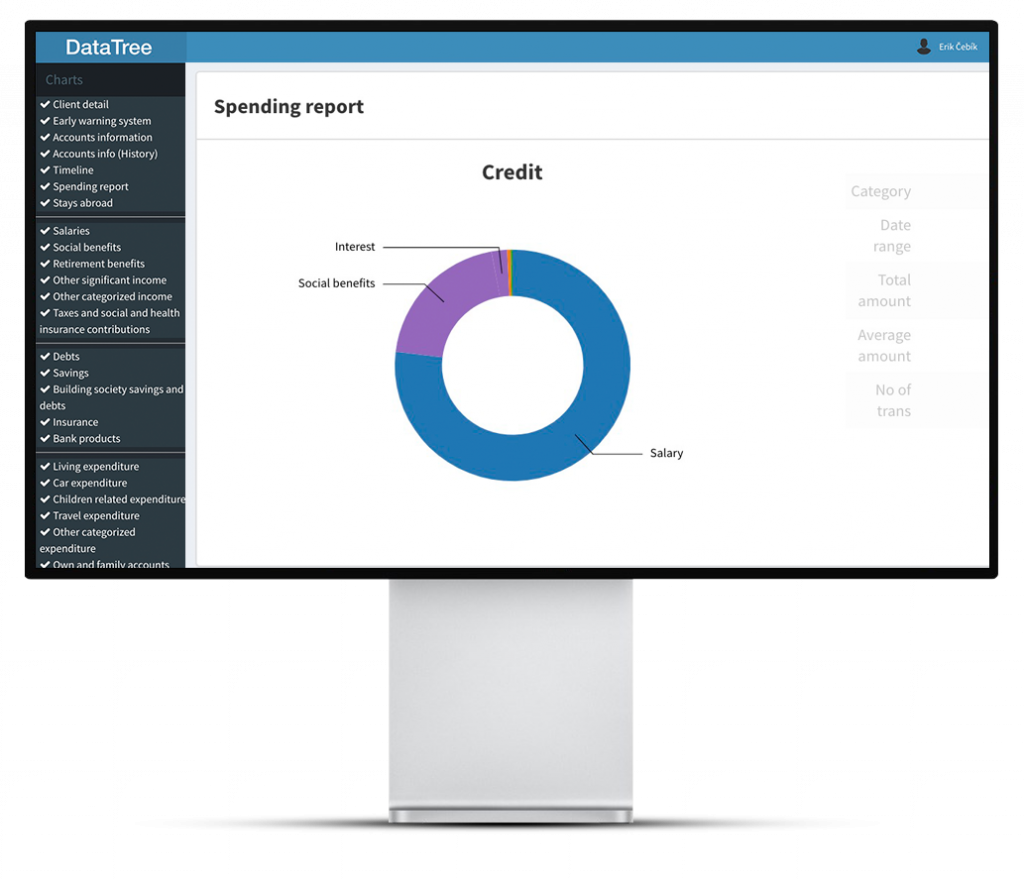

Automated financial advisory

Communicating pro-actively with clients to help them improve their financial healt.

Providing insightful financial advice builds on comprehensive transaction classification and client event detection.

Our automated classification engine supports various PFM and financial health related use cases including simple, however, most of the time inadequate spending reports.

In more advanced applications we derive insights and look for saving potential in clients’ discretionary and regular spending, help clients understand their overall household, car or children related expenses, or help them improve their monthly salary-to-salary cash flow.